CHAINS SUPPORTED

15+

DAILY TRADING VOLUME

$50,000,000

TRADING EXPERIENCE

CEX-Grade

HIGH-PERFORMANCE EXPERIENCE, LIQUIDITY AGGREGATION, SMART STRATEGIES

Re-imagine The Professional

On-Chain Trading Experience

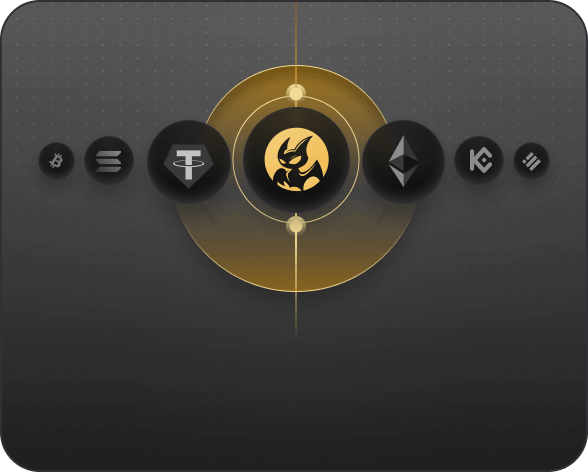

Cross-chain Support

Enable high-speed collaboration across multiple chains with one account for all aspects.

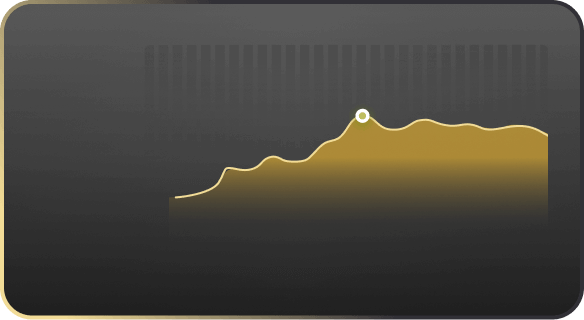

Liquidity Aggregation

Open up multi-source capital pools to enhance depth and efficiency.

Strategy Scheduling

Supports multi-dimensional strategy parallelism and intelligent regulation.

AI Summarization Engine

AI-driven liquidity infrastructure with built-in high-performance aggregation and path optimization.

Open Interface & Module Expansion

Standardized APIs are compatible with mainstream quantitative tool chains, flexibly adapting to diversified trading and asset needs.

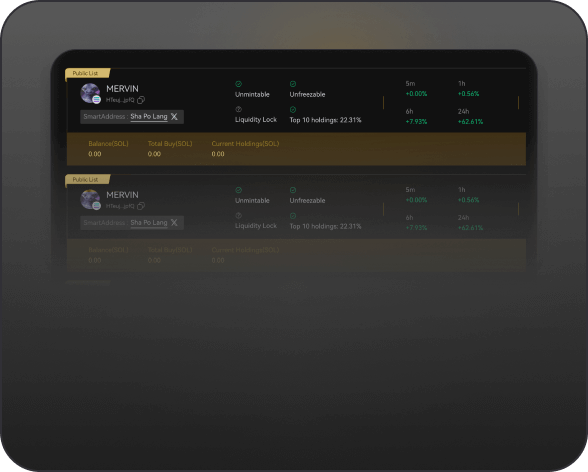

On-chain Security

Real-time monitoring and defense of potential risks on the chain.

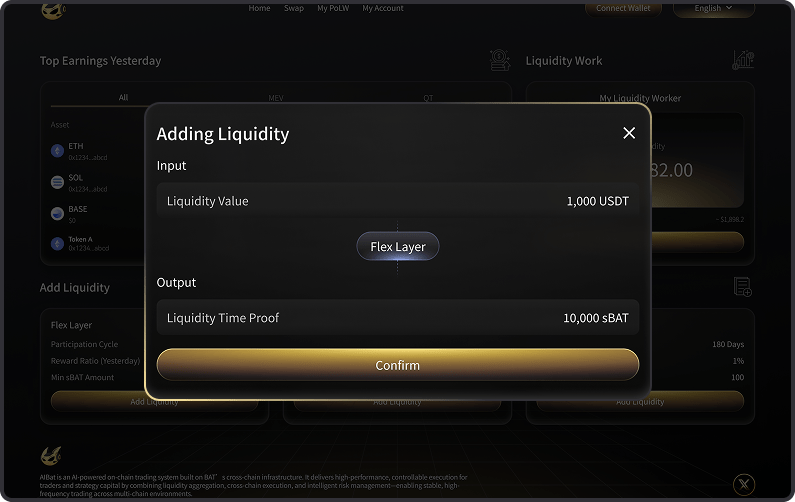

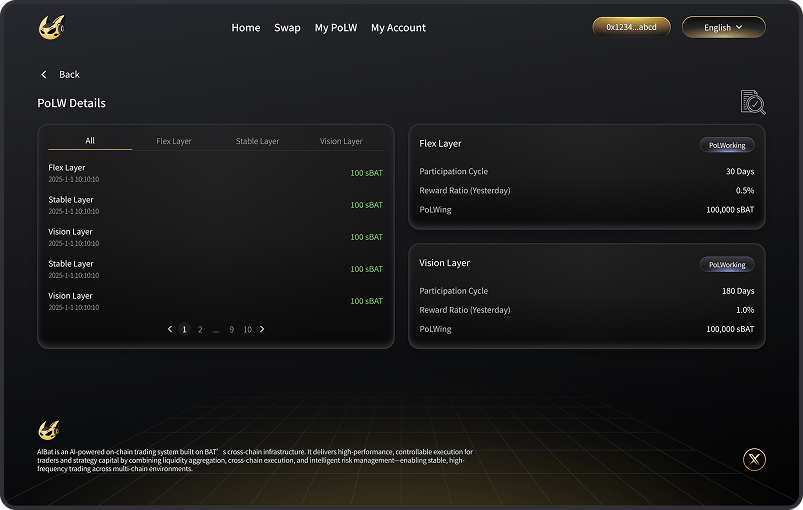

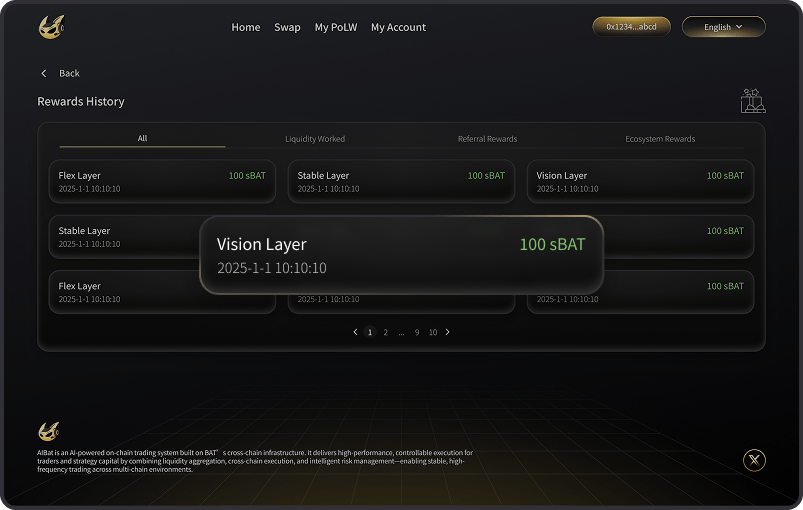

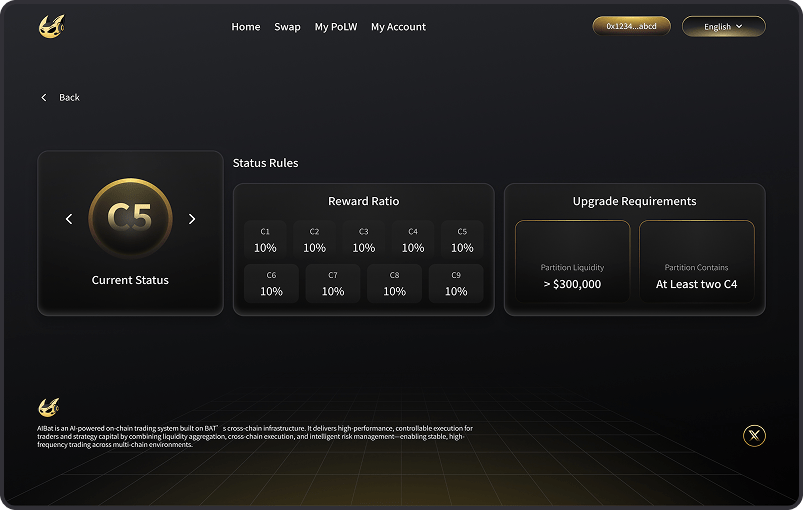

PoLW:

Proof of Liquidity Work

PoLW is the core consensus mechanism of the BAT protocol, aiming to transform financial contributions and user behavior into productivity that drives the system forward. It not only measures the value of liquidity, but also takes into account trading behavior and data feedback, creating a mechanism that is driven by a cycle of funding, data and incentives.

Liquidity Infusion

Users add liquidity to provide security for aggregation and market depth

Why it Matters

PoLW transforms capital and behavior into real productivity. Users are not only liquidity providers, but also participants in the intelligent evolution of the system. With the accumulation of scale and data, the efficiency of the protocol is continuously improved, forming a self-reinforcing closed loop of growth.

Eco-Application

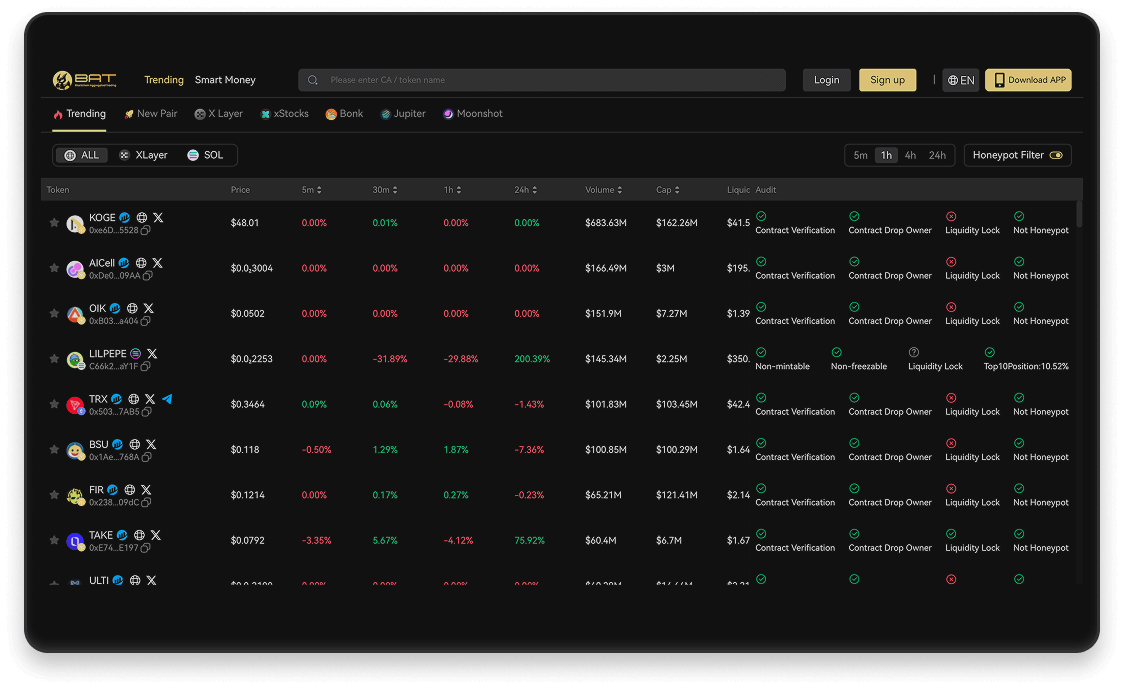

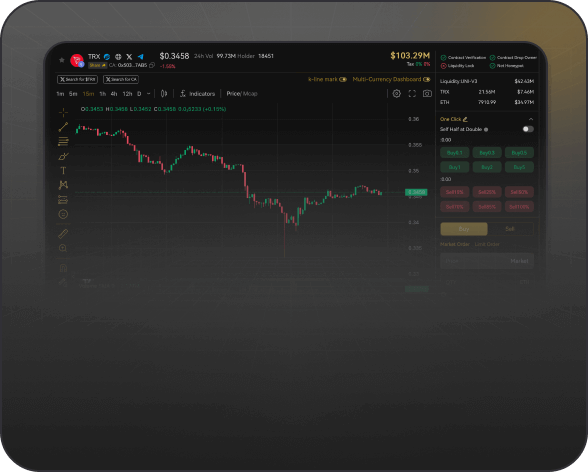

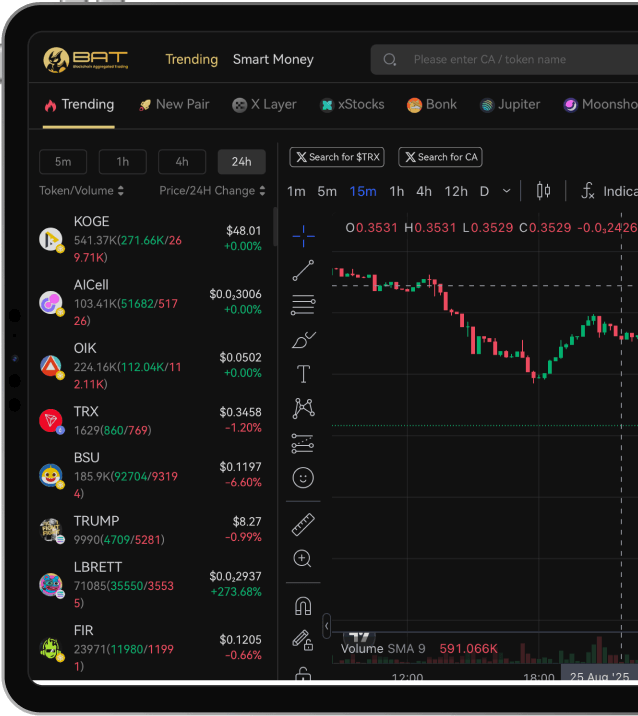

Not CEX, but better than CEX

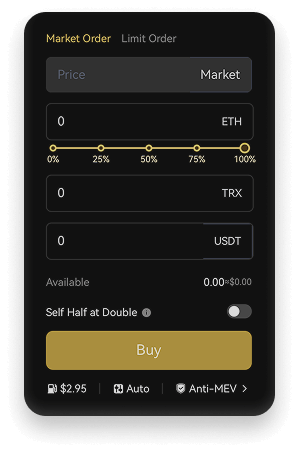

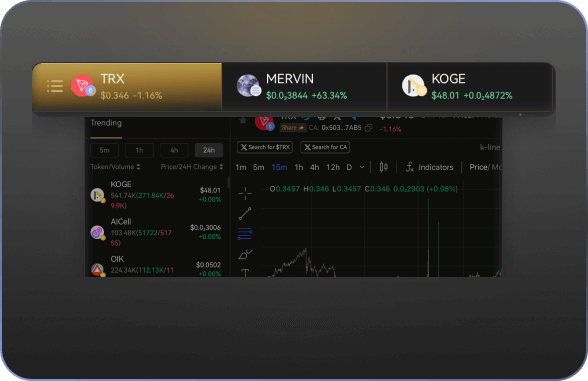

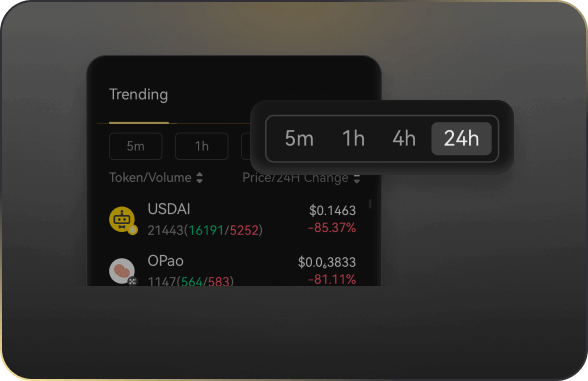

On-chain

Trading Terminal

Transactions return to the chain, providing a high-performance on-chain trading experience that exceeds CEX.

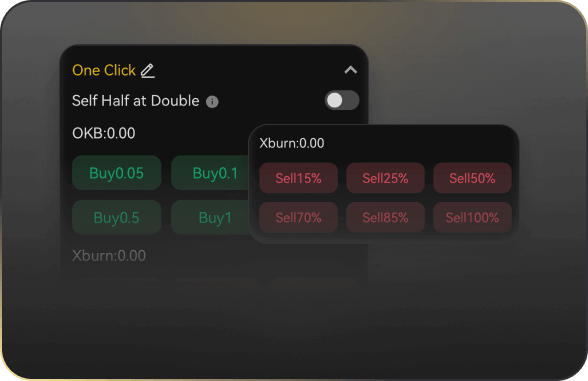

Built-in professional-grade order types (limit, take-profit/stop-loss, OCO, iceberg orders, etc.)

Intelligent routing system, multi-chain and multi-pool dynamic price search, reduce slippage and hidden costs

Strategy visualization and intelligence powered assistance

Chain-wide risk control framework: permission detection, blacklist interception, honeypot identification

Sub-second order response and rapid failure recovery to safeguard capital.

Liquidity Magician

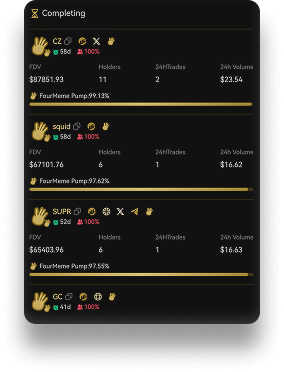

AIBAT On-chain

Intelligent Trading Engine

BAT native core function, intelligent execution system for institutions and strategy funds.

Open to third-party strategy providers and institutional traders

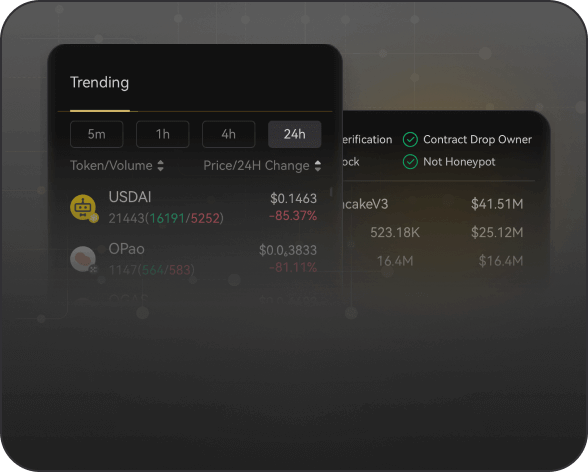

Capture short-cycle alpha opportunities

Strategy scheduling and self-learning optimization

Real-time market factor perception and scoring

Trusted issuance and transparent chaining

Asset Distribution Center

Launchpad for high-quality assets on the chain, building a one-stop issuance and trading closed loop.

One-stop market

Derivatives Trading

Cryptocurrencies, stocks, indices, commodities, RWAs, expanding space for hedging, arbitrage and yield optimization.

Synthetic derivatives on mainstream

U.S. stocks, thematic indices,

and crypto assets.

Supports margin, leverage and

inter-period arbitrage

Dual mode of perpetual and periodic settlement contracts

Deployed side-by-side with the main trading

terminal, sharing account and risk control system.